How to File a Connecticut LLC Amendment

To amend the Certificate of Organization for your Connecticut LLC, you’ll need to file a Certificate of Amendment with the Connecticut Secretary of State. Along with the amendment, you’ll need to pay a $120 filing fee. Here is a free guide filing your Certificate of Amendment.

Amend Certificate of Organization for a Connecticut LLC

As your Connecticut LLC evolves, you may need to update the information provided on your initial Certificate of Organization. For the most part, these changes can be made by filing a Certificate of Amendment.

When do I need to file the Connecticut Certificate of Amendment?

An LLC in Connecticut can file a Certificate of Amendment to update the entity’s name, member/manager information, and principal/mailing address. However, if you’re not changing your entity name, the Certificate of Amendment is not the most cost-effective option. For the following changes, use these forms to save a few dollars:

- Business Address: File a Change of Business Address Form ($50)

- Members or managers: File an Interim Notice of Change or Member/Manager Form ($20)

Is there anything I can’t update by filing a Connecticut LLC amendment?

You can’t change your Connecticut registered agent by filing an amendment. To update this information, file a Change of Agent Form OR Change of Agent’s Address Form. Both have a $50 filing fee.

Can I make changes on my Connecticut Annual Report instead of filing an amendment?

Yes. If you’re within 30 days of your due date, you can update your member/manager information, business address, and registered agent information when filing your Connecticut Annual Report ($80).

What do I include in the Connecticut LLC Certificate of Amendment?

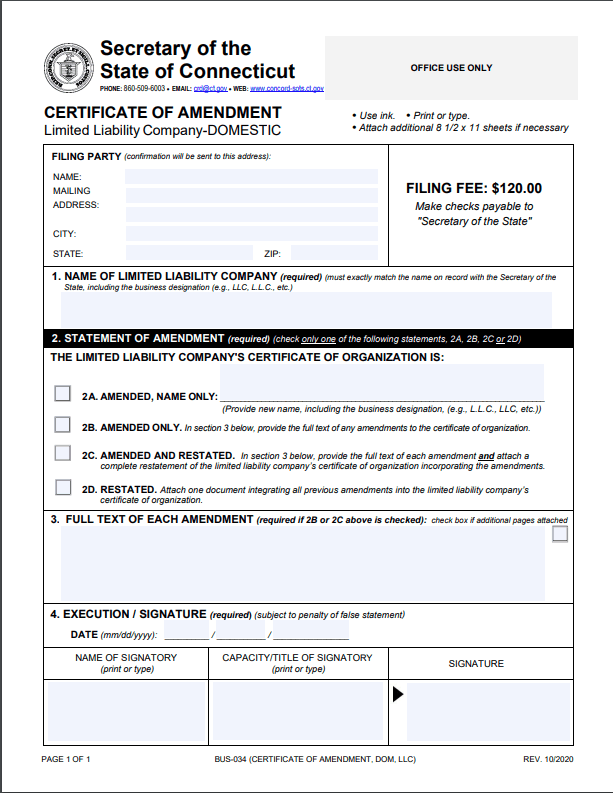

To complete the Connecticut Certificate of Amendment, you’ll need to include the following information:

- Filer information: Enter the name and mailing address of the individual filing the amendment.

- Entity name: Write the current name of your Connecticut LLC.

- Amended/restated amendment: Indicate whether you’re amending your entity’s name,updating the Certificate of Organization, restating and amending your LLC, or restating your Certificate of Organization.

- Amendments: Include all relevant amendments in the space provided. If you’re only amending your entity’s name, you can leave this section blank.

- Signature: Sign and print the name and title of the person filing the amendment.

- Fees: Include a payment for $120. Add an additional $50 for expedited (24-hour) processing.

How do I file the Connecticut Certificate of Amendment?

You can file the Connecticut Certificate of Amendment by mail, in person, or by fax. Mailed submissions can only be paid for by check/money order made payable to “Secretary of the State.” If you file in person, you can pay by using a check, money order, or credit card. Faxed filings must be paid using a credit card and include a Fax Filing Service Request Form.

How much does it cost to file a Connecticut LLC amendment?

The Certificate of Amendment costs $120 for standard processing. Need it expedited? Add an additional $50.

How long does it take to process the Connecticut Certificate of Amendment?

The Connecticut Certificate of Amendment takes 7-10 business days to process. Expedited processing is completed within 24 hours.

Can I restate the initial certificate instead of filing a Connecticut LLC amendment?

No, you can’t restate your initial certificate instead of filing an amendment. However, you can use the Certificate of Amendment form to restate your initial Certificate of Organization. Just check the box that reads “Restated” under Section 2 of the amendment form. The filing fee will be the same—$120.

Where do I submit the Connecticut LLC Certificate of Amendment?

The Certificate of Amendment must be filed with the Connecticut Secretary of State, Commercial Recording Division.

Mailed Filings

PO Box 150470

Hartford, CT 06115-0470

In-Person Filings

30 Trinity Street

Hartford, CT 06106

Faxed Filings

(860) 509-6069