Mutual Benefit Nonprofit Articles of Incorporation

Mutual benefit corporations are created by filing Nonprofit Articles of Incorporation with the state agency in charge of business formations (typically the secretary of state). Mutual benefit corporations are often eligible for federal tax-exempt status, but they do not qualify as 501(c)(3) tax-exempt organizations, which means donations to a mutual benefit corporation are not tax-deductible by their donors.

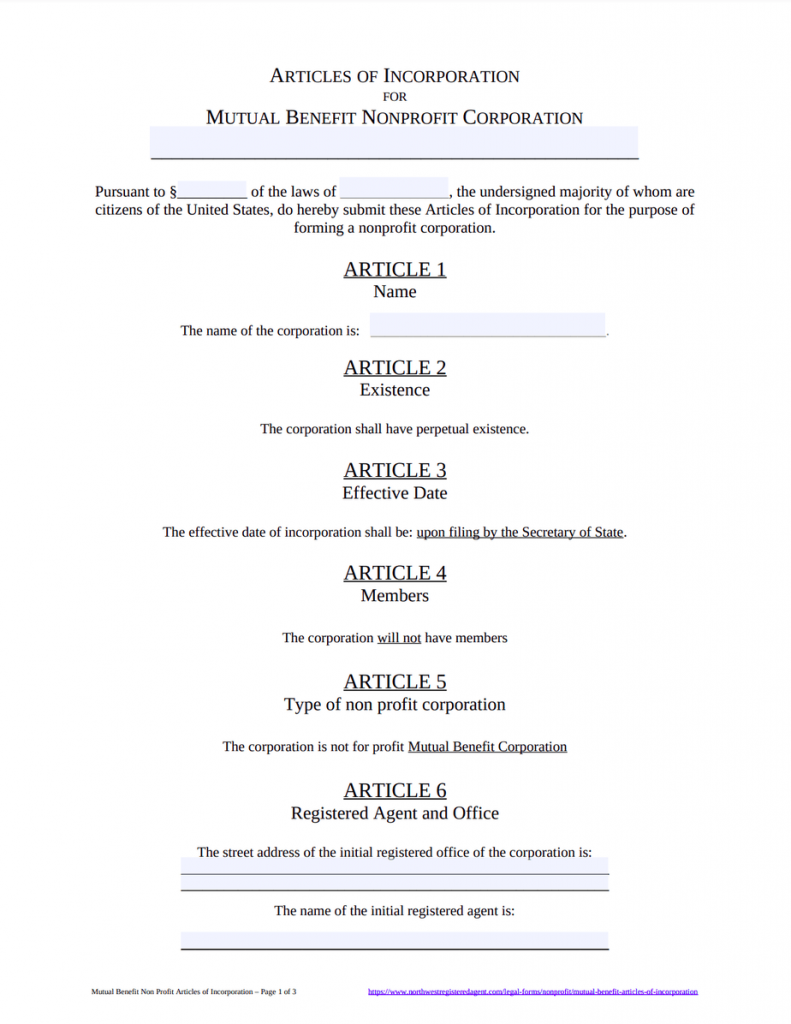

Mutual Benefit Articles of Incorporation – Free Template

You can use our adaptable template for writing Mutual Benefit Nonprofit Articles of Incorporation, but keep in mind that the form and the instructions below do not constitute legal advice and should not replace competent legal counsel.

What should Mutual Benefit Nonprofit Articles of Incorporation include?

The requirements for forming a mutual benefit corporation are not the same in every state, but all the states share basic similarities for a mutual benefit corporation’s Nonprofit Articles of Incorporation. Our free Mutual Benefit Articles of Incorporation template includes the most common requirements and can be adapted to fit any special requirements in your state:

Article 1: Name

You can do a business name search to see if your nonprofit’s name is available prior to filing paperwork with the state. Naming rules vary from state to state, but states commonly require mutual benefit nonprofit corporations to include a corporate suffix (“corporation,” “inc.,” etc.), to avoid misleading names, and to choose a name that differs from other businesses on record with the state.

Article 2: Existence

Your mutual benefit nonprofit can exist for a fixed period or perpetually (with no planned end in sight). Most nonprofits choose perpetual existence.

Article 3: Effective Date

Your organization’s effective date is the date when it officially comes into existence. Typically, a mutual benefit nonprofit’s filing date is the same as its effective date, but some states allow organizations to delay their effective dates (usually up to around 60 or 90 days, depending on the state, though some states don’t allow delayed effective dates).

Article 4: Members

This article identifies if your mutual benefit nonprofit will or will not have members. Members usually have voting rights and influence the organization’s major decisions, though some nonprofits also have nonvoting members (or no members at all).

Article 5: Type of Nonprofit Corporation

This article identifies the type of nonprofit corporation you intend to form: a mutual benefit corporation.

Article 6: Registered Agent and Office

Your registered agent is the individual or business you appoint to receive service of process (legal notices) for your mutual benefit nonprofit. Typically, your Nonprofit Articles of Incorporation must include the registered agent’s name and the location where the agent will receive service of process and other official state documents. We recommend hiring a registered agent service like Northwest.

Article 7: Principal Office

Your principal office is your nonprofit’s official address (the location where you actually conduct business), which doesn’t necessarily need to be in the state where you’re forming your nonprofit. Most states will require you to list a street address.

Article 8: Mailing Address

Include a distinct mailing address if your nonprofit’s mailing address is different from the address of its principal office.

Article 9: Directors

List the required information (usually just names and addresses) for your nonprofit’s initial directors. It’s common for nonprofits to have three initial directors, but state requirements vary.

Article 10: Indemnification

This article secures your nonprofit’s directors, officers, incorporators, members, and employees against personal liability for your nonprofit, so long as their actions are legal and in good faith.

Article 11: Purpose

This article describes your nonprofit’s purpose.

Article 12: Prohibited Activities

501(c)(3) tax exempt organizations must permanently dedicate their income and assets to IRS-approved nonprofit purposes (apart from reasonably compensating individuals for services rendered), ensure that the carrying on of propaganda and/or lobbying never makes up a substantial part of the organization’s activities, and avoid political campaign activism altogether. This article includes specific IRS language disallowing these activities.

Article 13: Distributions Upon Dissolution

Nonprofits seeking 501(c)(3) tax-exempt status must ensure that their income and assets never go toward personally enriching their directors, officers, members, or any other individual—and this includes if or when the nonprofit shuts down. This article—the dissolution clause—ensures that, apart from paying its debts, any distributions made in the event of the nonprofit’s dissolution will go toward furthering its nonprofit goals or get distributed to the federal, state, or local governments exclusively for the public benefit.

Article 14: Incorporator

Your incorporator is simply the individual who completes and submits your articles. Your incorporator doesn’t need to be part of your nonprofit. When you hire a Northwest to start your nonprofit, we’ll be your incorporator.

Are Mutual Benefit Nonprofit Articles of Incorporation requirements the same in each state?

No, but they are usually similar. Each state determines its own requirements, filing fees, allowing filing methods, and state processing times. This information is usually available online (though you’ll need to dig for it!), but Northwest has already done the research for you. Simply visit our Nonprofit Guide, and select your state to learn more.

What is the process for filing Mutual Benefit Nonprofit Articles of Incorporation?

All nonprofit Articles of Incorporation, regardless of the type of nonprofit, get filed at the state level in the US—typically with the office of the secretary of state or an equivalent state agency in charge of business formations. Once the state approves your nonprofit’s articles, however, you’ll still need to get a bank account, obtain any necessary permits and licenses, and get a federal EIN from the IRS. Most states also have annual or periodic filing requirements to keep up with along the way.