How to Register a California Series LLC

While you cannot start a domestic Series LLC in California, the state does recognize these types of LLCs. This means you can register a Series LLC as a foreign entity to do business in California by submitting an Application to Register a Foreign Limited Liability Company (Form LLC-5) with the California Secretary of State.

Registering a California Series LLC as a foreign entity is not like starting a typical LLC—the process poses some important distinctions worth exploring. This how to register a California Series LLC guide should be a good place to start.

What is a California Series LLC?

A California Series LLC is a business structure designed to allow a “parent” LLC to have one or more self-contained “series” or “cell” LLCs. Each cell is compartmentalized—financial records, bank accounts, management structures, and so on—in order to limit liability for each distinct cell. In other words, if one cell faces legal action or financial penalties, the parent LLC cannot be held liable, and the other cells are also protected so long as each cell conducts business separately, has distinct owners, and manages its own assets and debts.

Technically speaking, then, you can do business in California as a Series LLC, but rather than forming a Series LLC within the state, you’d have to register a California Series LLC as a foreign entity.

The Series LLC Guide: Learn about the Series LLC business structure in general, which states allow it, and the main steps involved in starting a Series LLC.

Hire a Registered Agent in California

Even if you already have a registered agent in the state where you created your Series LLC, California requires “an Agent for Service of Process” with a permanent address in the state of California. All this means is that you need an adult individual or registered agent service that can receive hand-delivered communication on behalf of your LLC during normal business hours.

Because you are registering a Series LLC in California as a foreign entity, you are most likely not physically present in California and do not qualify to be your own registered agent. Many foreign LLCs opt to hire a registered agent service. Hiring a registered agent service ensures not only that you’ll have a permanent address in California to accept communication on your behalf but that you’ll also receive communication quickly—for instance, our registered agent services include a business address and free mail forwarding to ensure our clients are always in compliance and up-to-speed.

California Registered Agent: Learn more about California Registered Agents.

Submit California Application to Register a Foreign LLC

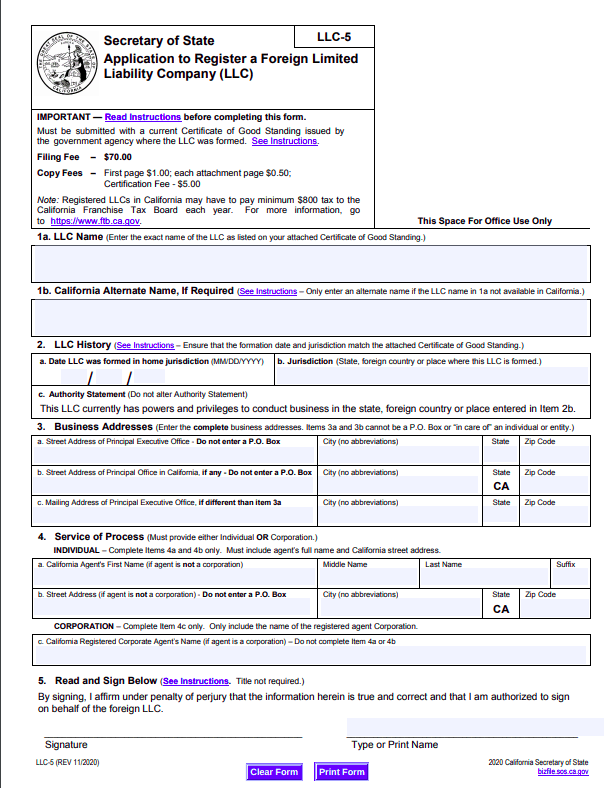

To register a foreign entity as a California Series LLC, you must submit an Application to Register a Foreign LLC (Form LLC-5) with the Secretary of State. This is the form used to register a typical LLC, and you will only need to file this form for the parent LLC. Be sure to attach a Certificate of Good Standing, which you can request from the agency where you first formed your business.

See the document below and click on any number to see what information is required in the corresponding section.

How much does it cost to register a California Series LLC?

There’s no sugarcoating it: registering a California Series LLC can be costly. With the cost to file an Application to Register a Foreign Limited Liability Company ($70), a Statement of information ($20), the annual franchise tax ($800 per cell), and potentially additional fees based on your California LLC’s projected income, registering your California Series LLC requires substantial capital over time.

How long does it take to register a California Series LLC?

It generally takes about 2 months to complete the registration process. There are options to expedite the process for additional fees. If you can submit your Application to Register a Foreign Limited Liability Company in person at the Sacramento office during regular business hours, a $15 fee provides priority service over documents submitted by mail.

If registering your California Series LLC is urgent, it is possible to have the state review it more quickly. You can review preclearance and expedited filing services, but to give you an idea of cost, 24-hour preclearance service (Class I) costs $500 and 4-hour state filing service (Class A) also costs $500.

File a Statement of Information

Within 90 days of registering with the California Secretary of State, you must file a Statement of Information (Form LLC-12) for each cell of your Series LLC that will do business in California. There is an initial filing fee of $20, and you will be required to file again every two years, paying the $20 filing fee each time for each cell that does business in California.

To put this in perspective, if you formed a Series LLC in Delaware and decided that you want 5 of your cells to also do business in California, then those 5 cells would each need to file a Statement of Information. In total, you would pay $100 every other year to file a statement of information for each cell.

To complete the Statement of Information, you’ll need to provide:

- The exact name of your LLC as it is registered with the California Secretary of State

- Your 12-digit Entity Number issued by the California Secretary of State

- The place in which your Series LLC was initially formed

- The name of at least one member or manager for each LLC cell

- The business address for your LLC, your registered agent

- A brief description of your LLC’s business activity

- The business or residential address of the CEO

Finally, you’ll just need someone authorized to sign and date the form on behalf of your LLC.

Pay California Annual Franchise Tax

California’s Franchise Tax Board levies an $800 annual tax on every LLC that is doing business or organized in California. For a Series LLC, you will need to pay an $800 annual tax for each cell operating in California. So, if you have 17 cells in your Series LLC and 5 of them will be doing business in California, you will need to pay the annual tax for each of 5 doing business in California. These payments are due:

- First year annual tax: the 15th day of the 4th month from the date you file with the Secretary of State

- Subsequent years tax: the 15th day of the 4th month of your taxable year

When paying your tax, you will need to submit a Limited Liability Company Tax Voucher (Form FTB 3522) and a Limited Liability Return of Income Form (Form 568) for each cell doing business in California. Both forms require that you:

- Fill out the document in black of blue ink

- List your California Secretary of State file number (issued to you upon registering your California Series LLC)

- Include your federal employer identification number (FEIN)

For Form FTB3522 in particular, you will also need to write “Series LLC # _____” after the name of each series you have registered in California and specify “Series LLC” on the top right corner of the voucher.

Both forms can be sent to the below address along with a check or money order. Payments can also be made electronically to the Franchise Tax Board and scheduled up to a year ahead of time for future payments.

Franchise Tax Board

PO Box 942857

Sacramento CA 94257-0501

Obtain any Required Business Licenses

In California, the majority of business licenses are not issued at the state level. Instead, most licenses are issued at the city or county level.

Do I need a business license when I register a California Series LLC?

More than likely, yes. You’ll want to review California’s various licensing requirements at both the Governor’s Office of Business and Economic Development and the California Department of Consumer Affairs, but will likely need some business license to conduct your California Series LLC business. Depending on the kind of business you conduct, you might need to get a license for each cell.