Register a Guam Foreign LLC

A Guam Foreign LLC is an LLC that does business in Guam but was organized in another jurisdiction. To register a foreign LLC in Guam, you'll need to register with Guam's Department of Revenue and Taxation and pay a $250 filing fee. In most cases, a foreign LLC will need to register with the Guam Department of Revenue and Taxation if it does any of the following on the island of Guam: hires and pays employees, renders professional and retail services, or leases property for the purpose of selling or storing inventory meant for retail sales.

Ready to register your LLC to do business in Guam? Here are the key details you'll need to know.

How to Register a Foreign LLC in Guam

Registering a foreign LLC in Guam requires filing a Certificate of Registration form. The process to register as a foreign LLC is also known as Foreign Qualification. Here are the steps you’ll need to take:

1. Appoint a Guam Registered Agent

Guam requires all LLCs—including foreign LLCs—to maintain a registered agent. According to 18 Guam Code § 15111, your registered agent must be either:

- An individual who is a resident of Guam

- A domestic corporation registered on Guam

- A foreign corporation registered to do business on Guam

Whatever the case, your registered agent must have a physical address in Guam and be able and available to accept service of process (legal mail) during regular business hours.

Unless you actually live on Guam and have a street address there, you can’t be your own registered agent in Guam. Most foreign LLC owners hire a professional registered agent service.

2. Obtain a Certificate of Good Standing

You must include a Certificate of Good Standing (or equivalent document from your state) in your application for foreign registration on Guam. This document simply shows Guam’s government that your LLC has paid all required taxes and fees and is active in its state of formation.

The process to obtain a Certificate of Good Standing varies by state. In most cases, you can obtain a Certificate of Good Standing online through your secretary of state.

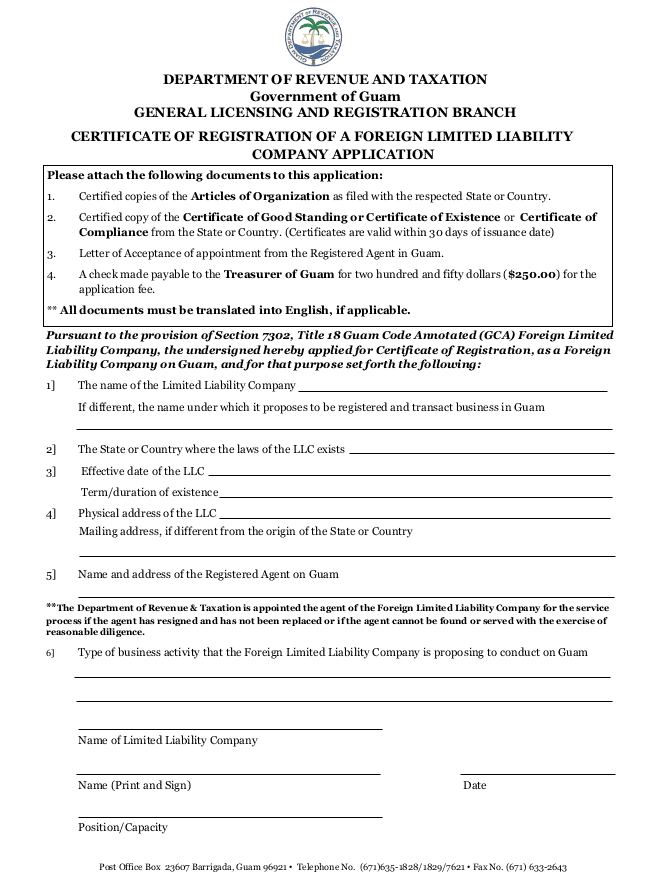

3. Complete the Application for Certificate of Registration

You’ll need to submit the Certificate of Registration of a Foreign Limited Liability Company Application form to the Guam Department of Revenue and Taxation. Here’s what you’ll need to include:

- LLC name (and name you’ll use to transact business in Guam, if different)

- Location (state or country) of home jurisdiction

- Date of LLC formation in home jurisdiction (“effective date”)

- Duration (if your LLC has a planned end date)

- Physical address of LLC (and mailing address, if different)

- Name and address of registered agent on Guam

- A brief description of the business activities you’ll do on Guam

- Signature

You must also attach to your application the following items:

- Certificate of Good Standing

- Certified copy of your company’s Articles of Organization

- Letter of Acceptance from your registered agent on Guam

The filing fee for registering a Guam foreign LLC is $250, which should be paid by check or money order.

While you may file some taxes and apply for a business license online through Guam’s Online Business Services, you must submit your Application for Certificate of Registration via regular mail to this address:

Director

Department of Revenue and Taxation

Government of Guam

P.O. Box 23607

Barrigada, Guam 96921

No. Articles of Organization are only filed to form a new LLC. To register to do business in Guam as a foreign LLC, you need to file a Certificate of Registration.

4. Receive Your Certificate of Registration

After the Guam Department of Revenue and Taxation has reviewed and approved your application, you will receive your Certificate of of Registration in the mail.

Because Guam only allows mailed filings, and no expedited options, the time it takes to receive verification of your LLC’s foreign registration varies from two weeks to about a month.

Guam Foreign LLC Registration FAQ

You can amend your foreign LLC registration by filing an amendment to the Guam Department of Revenue and Taxation. The department does not provide an amendment form, but it specifies that your amendment must contain language that corrects your Certificate of Foreign Registration and a signature from someone authorized to do business on behalf of your LLC.

11 Guam Code § 26101 states that “Business and Engaging in Business includes all activities whether personal, professional or corporate, carried on within Guam for economic benefit either direct or indirect.” Such activities typically include:

- Owning and leasing property

- Storing inventory

- Hiring employees

- Rendering professional services

More specifically, 18 Guam Code § 7306 lists activities NOT considered doing business:

- Holding board meetings (or activities related to internal affairs)

- Being engaged in court proceedings

- Maintaining a bank account

- Maintaining offices for the transfer of securities

- Using independent contractors for sales

- Receiving orders from Guam (filled / accepted elsewhere)

- Acquiring debt in real or personal property

- Owning real or personal property

- Conducting isolated transactions (completed within 60 days)

For more, check out Northwest’s page: What Exactly Does “Doing Business” in Another State Mean?

Yes. If your LLC is registered to do business in Guam, you must file the Guam Sworn Annual Report with the Department of Revenue and Taxation. The due date is September 1st, and the fee is $100.

Foreign LLCs are taxed like domestic Guam LLCs. In general, LLCs are treated as pass-through entities, which means your business profits will “pass through” the business entity and be reported by your LLC members on their individual tax returns.

To withdraw your Guam foreign LLC, you’ll need to file a Certificate of Cancellation. This certificate should include a statement of intent to withdraw your foreign LLC registration in Guam, along with the signature of a person authorized to sign on behalf of your company, according to the laws of the jurisdiction in which your LLC was formed. Note that this doesn’t change the status of your LLC in its home jurisdiction—it just removes its authority do business on Guam.