How to Reinstate a West Virginia LLC

To revive a West Virginia LLC, you’ll need to file the Application for Reinstatement of Revoked or Administratively Dissolved LLC with the West Virginia Secretary of State. You’ll also have to fix the issues that led to your West Virginia LLC’s dissolution and obtain a Letter of Good Standing from the West Virginia State Tax Department. Below, we provide a free, step-by-step guide to reinstating your West Virginia LLC.

Revive Or Reinstate A West Virginia LLC

The West Virginia Secretary of State has the power to administratively dissolve your West Virginia LLC if you fail to do any of the following:

- pay any fees, taxes, or penalties

- file an annual report

In order to get back into business again, you can apply for reinstatement. To revive or reinstate your West Virginia LLC, you’ll need to submit the following to the West Virginia Secretary of State:

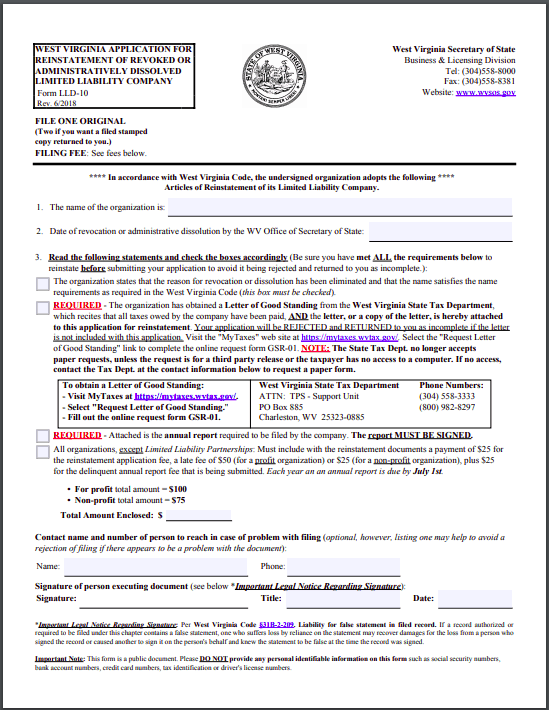

- a completed West Virginia Application for Reinstatement of Revoked or Administratively Dissolved Limited Liability Company (Form LLD-10).

- a Letter of Good Standing from the West Virginia State Tax Department

- a current annual report

- the $100 filing fee

West Virginia Tax Clearance

Before you can file a West Virginia Application for Reinstatement, you’ll need to obtain a Letter of Good Standing from the West Virginia State Tax Department. Requesting a Letter of Good Standing is free, but you won’t get one unless you’re caught up on all your taxes.

How do I request a Letter of Good Standing for a West Virginia LLC?

To request a Letter of Good Standing for your LLC, you need to submit a completed West Virginia Request for Statement of Good Standing (Form GSR-01) to the West Virginia State Tax Department.

If you don’t have access to a computer or want your Letter of Good Standing released to someone who is not your CPA or attorney, you’ll need to file the paper version.

All other requests must be made online. You can submit the form through the West Virginia State Tax Department’s website.

How long does it take to receive West Virginia tax letter?

The fastest way to get your West Virginia Letter of Good Standing is to file online with a MyTaxes account. If you have a MyTaxes account, you’ll receive your Letter of Good Standing the following business day.

If you file online without an account, your response will be mailed to you, which will add a few days.

Paper filings take 2-3 weeks to process.

West Virginia LLC Reinstatement

Once you have your West Virgina Letter of Good Standing, you can move on to the next step towards reinstating your LLC: completing the West Virginia Application for Reinstatement.

What information do I need for the West Virginia Application for Reinstatement?

To fill out the West Virginia Application for Reinstatement, you’ll need to provide your LLC’s name, the date of administrative dissolution, and contact information for someone who can help with any filing problems (this is optional but can speed up processing time).

You’ll need to check the boxes affirming that you have done all of the following:

- fixed the problem that led to dissolution

- made sure the name is still unique

- attached a Letter of Good Standing to your application

- attached a current annual report

- included a $100 filing fee

The form should be signed bya member, manager, or person authorized to do business on behalf of your West Virginia LLC.

You’ll also need to attach a current West Virginia LLC annual report.

How do I file the West Virginia Application for Reinstatement?

You can submit the West Virginia Application for Reinstatement to the West Virginia Secretary of State Business & Licensing Division. You can file by e-mail, fax, mail, in-person. You can pay by credit card, check, money order, or cashier’s check (made payable to “West Virginia Secretary of State”). If you hand-deliver your documents, you can also pay with cash.

You’ll need to include the Customer Order Request form and mark a box indicating how you’d like your order processed (standard, 24-hour, 2-hour, or 1-hour service) and how you’d like your filing returned to you. If paying by credit card, you’ll also need to attach the e-Payment Authorization form and provide credit card information.

Both of these forms are included with the West Virginia Application for Reinstatement.

How much will it cost to revive a West Virginia LLC?

The filing fee for a West Virginia Application for Reinstatement is $25, but you’ll also need to include a $50 late fee and a $25 annual report fee, so it costs $100 total.

You can pay extra for expedited service as follows:

24-hour: $25

2-hour: $250

1-hour: $500

If you’re expediting, be sure to specify the service you’d like on the Customer Order Request form.

How long does it take the state to process the West Virginia Application for Reinstatement?

Without expediting, it takes the West Virginia Secretary of State Business & Licensing Division about 5-10 business days to process reinstatement applications.

Can you change your West Virginia registered agent on the West Virginia reinstatement?

Yes, you can change your West Virginia registered agent on the West Virginia reinstatement application.

How long do you have to revive a West Virginia LLC?

You can revive a business for two years following administrative dissolution, as long as your LLC’s name wasn’t adopted by another company while it was dissolved. If your name was taken or if more than two years have passed since administrative dissolution, you’ll need to start over and form a new West Virginia LLC.

Where do I submit my West Virginia Application for Reinstatement?

Reinstatement applications are processed by the West Virginia Secretary of State, Business & Licensing Division. You can email an attachment of your filing to CorpFilings@wvsos.gov, or fax, mail, or hand-deliver it to one of three offices:

Charleston Office

One-Stop Business Center

1615 Washington Street East

Charleston, WV 25311

Fax: (304) 558-8381

Clarksburg Office

North Central WV Business Center

200 West Main Street

Clarksburg, WV 26301

Fax: (304) 627-2243

Martinsburg Office

Eastern Panhandle Business Center

229 E. Martin St.

Martinsburg, WV 25401

Fax: (304) 260-4360