How to Reinstate a South Carolina LLC

To revive a South Carolina LLC, you’ll need to file the Application for Reinstatement by a Limited Liability Company Dissolved by Administration with the South Carolina Secretary of State. You’ll also have to fix the issues that led to your South Carolina LLC’s dissolution and obtain a tax clearance certificate from the South Carolina Department of Revenue. Below, we provide a free, step-by-step guide to reinstating your South Carolina LLC.

Revive A South Carolina Limited Liability Company

The South Carolina Secretary of State has the power to administratively dissolve your LLC if you fail to pay the franchise tax.

In order to get back into business again, you can apply for reinstatement. To revive or reinstate your South Carolina LLC, you’ll first need to pay any past due taxes. Then you’ll need to submit the following to the South Carolina Secretary of State:

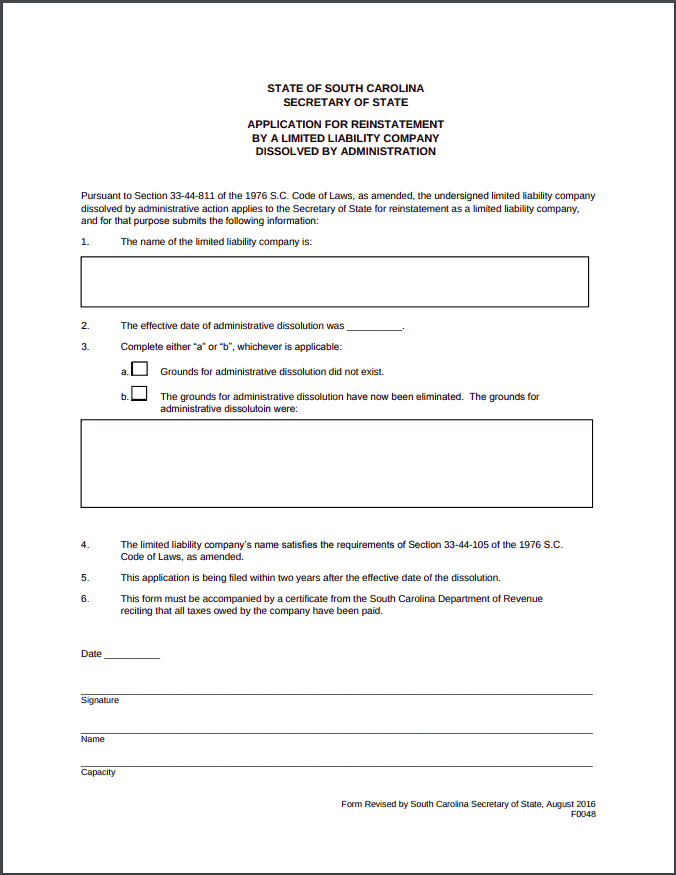

- a completed South Carolina Application for Reinstatement by a Limited Liability Company Following Administrative Dissolution

- a Certificate of Tax Compliance from the South Carolina Department of Revenue

- a $25 reinstatement fee

What information do I need for the South Carolina Reinstatement Application?

To file the South Carolina Application for Reinstatement, you’ll need to list your LLC’s name, the date of administrative dissolution, and the reason your LLC was dissolved. It also includes a statement affirming that you’ve corrected the issue that led to dissolution. If your LLC is managed by members, a member must sign it. If it’s managed by managers, a manager should sign.

How do I file the South Carolina Application for Reinstatement?

You can submit the South Carolina Application for Reinstatement by mail or in person. Make sure to submit the filing in duplicate and include a check for $25 made payable to “Secretary of State.”

Where do I submit my South Carolina Application for Reinstatement?

Reinstatement applications are processed by the South Carolina Secretary of State.

Mailed and In-Person Filings:

Attn: Corporate Filings

1205 Pendleton Street, Suite 525

Columbia, SC 29201

How much will it cost to revive a South Carolina LLC?

The filing fee for an Application for Reinstatement is $25. You’ll also have to pay any overdue taxes and penalties along with a $60 fee to request a Certificate of Tax Compliance.

How long does it take to reinstate a South Carolina LLC?

It takes the South Carolina Secretary of State 2-3 business days to process the reinstatement application. However, if you factor in the time it will take the South Carolina Department of Revenue to issue your Certificate of Tax Compliance (about two business days), completing your reinstatement could take up to a week.

Can you change your registered agent on the South Carolina reinstatement?

No, you can’t change your South Carolina registered agent on the South Carolina reinstatement. To change your registered agent in South Carolina, you’ll have to file a Change of Designated Office or Agent of Service of Process, or Address of Agent – Limited Liability Company with the Secretary of State.

How long do you have to revive a South Carolina LLC?

You can revive a business in South Carolina within two years after the date of dissolution. After that time, you’ll have to start over and form a new South Carolina LLC.

South Carolina Tax Clearance

Before you can submit your South Carolina Application for Reinstatement, you’ll need to obtain a letter from the Department of Taxation clearing your business of tax liability. If you’re behind on taxes, this means you’ll need to first submit any past filings or payments.

How do you get a tax clearance letter for a South Carolina LLC?

To get a Certificate of Tax Compliance from the South Carolina Department of Revenue, you’ll need to submit the Certificate of Tax Compliance Request (Form C-268) to the Department of Revenue along with a $60 filing fee.

How long does it take to receive South Carolina tax clearance?

If you’re current on taxes, it typically only takes the South Carolina Department of Revenue 1-2 business days to issue a Certificate of Tax Compliance. The Certificate of Tax Compliance will be sent via email to whatever email address you provide on the request form.

Where do I file my South Carolina Certificate of Tax Compliance Request?

You can submit your request to the South Carolina Department of Revenue by fax, email, or mail. However, the South Carolina Department of Revenue will not accept electronic payments, so you’ll have to send a check or money order in the mail.

Mailed Filings:

South Carolina Department of Revenue

Certificate of Tax Compliance

Attention: Jean Funches

PO Box 125

Columbia, SC 29214

Faxed Filings:

803-896-0151

Email:

COCRequests@dor.sc.gov