How to Reinstate a Tennessee LLC

To revive a Tennessee LLC, you’ll need to file the Tennessee Application for Reinstatement Following Administrative Dissolution/Revocation with the Tennessee Secretary of State. You’ll also have to fix the issues that led to your Tennessee LLC’s dissolution and obtain a tax clearance letter from the Tennessee Department of Revenue. Below, we provide a free, step-by-step guide to reinstating your Tennessee LLC.

Revive A Tennessee Limited Liability Company

The Tennessee Secretary of State has the power to administratively dissolve your LLC if you fail to do any of the following:

- file an annual report

- appoint and maintain a registered agent

- pay any fees or penalties

In order to get back into business again, you can apply for reinstatement. To revive or reinstate your Tennessee LLC, you’ll need to submit the following to the Tennessee Secretary of State:

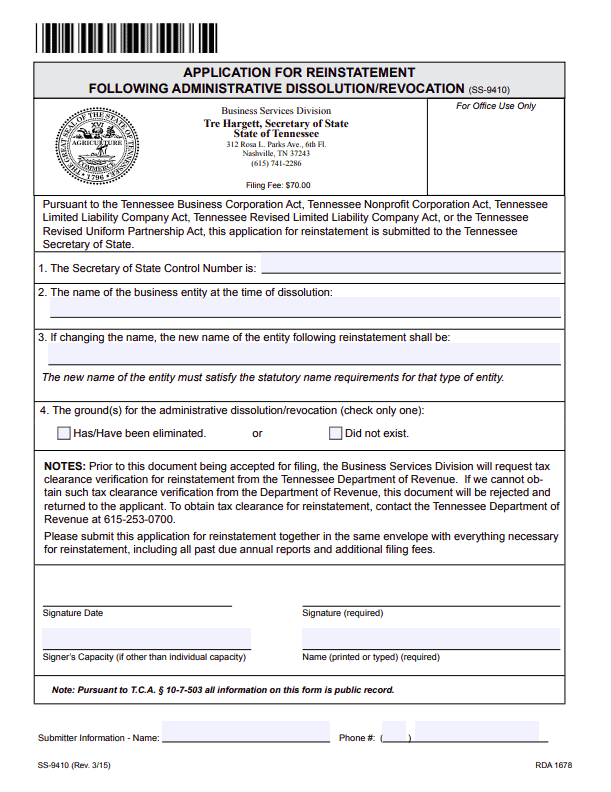

- a completed Application for Reinstatement Following Administrative Dissolution/Revocation

- the $70 reinstatement fee

- all overdue annual reports and filing fees

- a tax clearance letter from the Tennessee Department of Revenue

What information do I need for the Application for Reinstatement?

To file the Application for Reinstatement, you’ll need to provide your LLC’s Tennessee Secretary of State Control Number, name, and if needed, a new name. The form also includes a statement affirming that you’ve fixed the problem that led to administrative dissolution. It can be signed by anyone authorized to do business on behalf of the LLC.

You’ll need to attach any overdue annual reports and filing fees to your application.

The Business Services Division won’t process your reinstatement until it receives a tax clearance letter from the Tennessee Department of Revenue.

How do I obtain tax clearance from the Tennessee Department of Revenue?

You’ll need to log into your Tennessee Taxpayer Access Point account. If you don’t have an account, you’ll need to create one. Once you’re logged in, you can select a button to request tax clearance.

If you’ve paid all your taxes, the Tennessee Department of Revenue will mail you a tax clearance letter within 3-5 days. They’ll also send an electronic copy to the Tennessee Secretary of State.

Not sure if you’re current on taxes? Call the Tennessee Department of Revenue at 615-253-0700.

How do I file the Tennessee Application for Reinstatement?

You can submit the Tennessee Application for Reinstatement online, by mail, or in person. To file online, you can use your name or Secretary of State Control Number to search for your Tennessee LLC on the Secretary of State’s Business Information Search. From there, you can choose to reinstate online or use the system to fill out your application and print it out. Payment options depend on how you plan to file:

- Mail: Check, cashier’s check, or money order (payable to “Tennessee Secretary of State”

- In Person: Cash, check, cashier’s check, money order, credit card, or debit card

- Online: Credit card, debit card, or e-check (small convenience fee applies)

How much will it cost to revive a Tennessee LLC?

The filing fee for a Tennessee Application for Reinstatement is $70. You’ll also have to pay the filing fee ($300 for an LLC with 1-6 members) for each past due Tennessee Annual Report.

How long does it take the state to process the Tennessee reinstatement form?

It takes the Tennessee Department of Revenue about 3-5 business days to issue tax clearance, assuming you’re caught up on taxes. Once the Secretary of State receives your tax clearance, it may take another 1-2 business days to process your reinstatement application.

Can you change your registered agent on the Tennessee reinstatement?

You can’t change your Tennessee registered agent on the Tennessee reinstatement, but you can change your registered agent on your annual report or by filing the Tennessee Change of Registered Agent form.

How long do you have to revive a Tennessee LLC?

You can revive a business in Tennessee at anytime. However, once your Tennessee LLC is administratively dissolved, its name immediately becomes available for other companies to use.

What if my Tennessee LLC’s name was taken during administrative dissolution?

If another Tennessee company has adopted your LLC’s name, you’ll need to choose another name and list it on the reinstatement application.

Where do I submit my Tennessee Application for Reinstatement?

Reinstatement applications are processed by the Tennessee Secretary of State.

ATTN: Corporate Filing

312 Rosa L Parks Ave FL 6

Nashville, TN 37243