Register a Foreign Corporation in Oregon

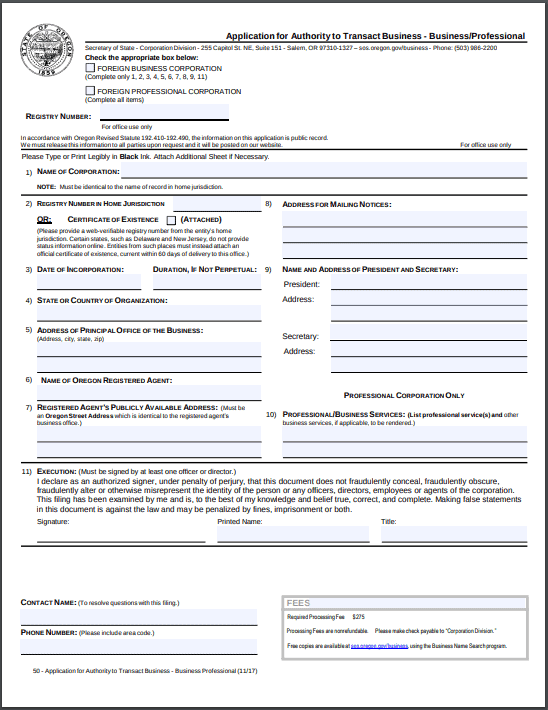

Register a foreign corporation in Oregon by filing an Oregon Application for Authority with the Oregon Secretary of State, Corporation Division. You can submit your application by mail, fax, or in person. It costs $275 to file.

Below, you’ll find answers to frequently asked questions about how to file the Application for Authority and register a foreign corporation in Oregon. Or, sign up for our Oregon Foreign Corporation Service, and we’ll handle your filing instead!

Free PDF Download

Download the Oregon Application for Authority. Fill out the form and submit it to the state.

Do It Yourself Online

Our free account and tools will walk you through registering your Foreign Corporation in Oregon. All for free.

When You Want More, Get More

Hire Northwest and let the experts register your Foreign Corporation in Oregon. Includes 1 year of registered agent service.

Free Guide to Registering a Foreign Corporation in Oregon

How much does it cost to register a foreign corporation in Oregon?

$275 for normal processing, $50 for nonprofit, and $5 additional for an optional confirmation copy.

How long does it take for the state to process the Oregon Certificate of Authority?

Normal Processing: Oregon processes mailed documents in about five business days, plus additional time for mailing.

In Person Processing: Hand delivered documents are processed by the state while you wait.

Fax Filing Processing: Faxed paperwork is processed by the state in about seven business days, plus additional time for mailing return notifications.

Online Processing: Oregon processes online filings within one business day.

How will I get verification of acceptance back from Oregon?

You will receive an acknowledgement letter by mail. If filing online, you will receive an email confirmation.

What forms do I file with Oregon to qualify my foreign corporation?

The Application for Authority to Transact Business form, a certificate of existence (also called a certificate of good standing), and the filing fee are required.

What do I need from my home state?

A certificate of existence is required.

Does it need to be an original copy?

No.

How current does the certificate need to be?

It must be current within 60 days of filing.

Will I need an Oregon registered agent for my foreign corporation?

Yes. Oregon requires all formal business entities to have an Oregon registered agent. We charge $125/year to serve as your registered agent in Oregon. You’ll not only get exceptional service, we’ll set you up with a domain name for free (for the first year), and a limited trial of our website, phone, email, and business address services.

What’s the best way to get an address in Oregon as a foreign corporation?

When you hire us as your registered agent or to start your business, you can use our registered office address. But if you need more—like a real office presence—we’ve got you covered.

Our Oregon Virtual Office includes a local phone number, mail forwarding, a unique Portland address (with a lease), and access to our expert Corporate Guides®—all for just $29/month.

Don’t need the full office setup? Try our Oregon Mail Forwarding Service with same-day digital scans or weekly physical forwarding to keep your home address private.

Does the Oregon registered agent need to sign the filing?

No.

How can I file the Oregon Certificate of Authority?

By mail, fax, in person, or online.

What is the state agency that accepts the foreign registration?

Oregon Secretary of State

Corporation Division

255 Capitol St. NE, Suite 151

Salem, OR 97310-1327

Phone: (503) 986-2200

Fax: (503) 378-4381

Do the signatures on the Oregon corporation application need to be original?

No.

Who has to sign the foreign corporation filing?

At least one officer or director must sign the form.

Are there any weird things about registering in Oregon?

County filing or publication is not necessary for foreign corporations, unless specifically required by the county in which your registered agent resides.

Are there ongoing Oregon annual report and/or initial reporting requirements?

Oregon Annual Reports are due on the anniversary from when you initially file.

Tip: Skip the extra paperwork and hire us to file for you, just $100 + state fees.