How To Start A Nonprofit In Nebraska

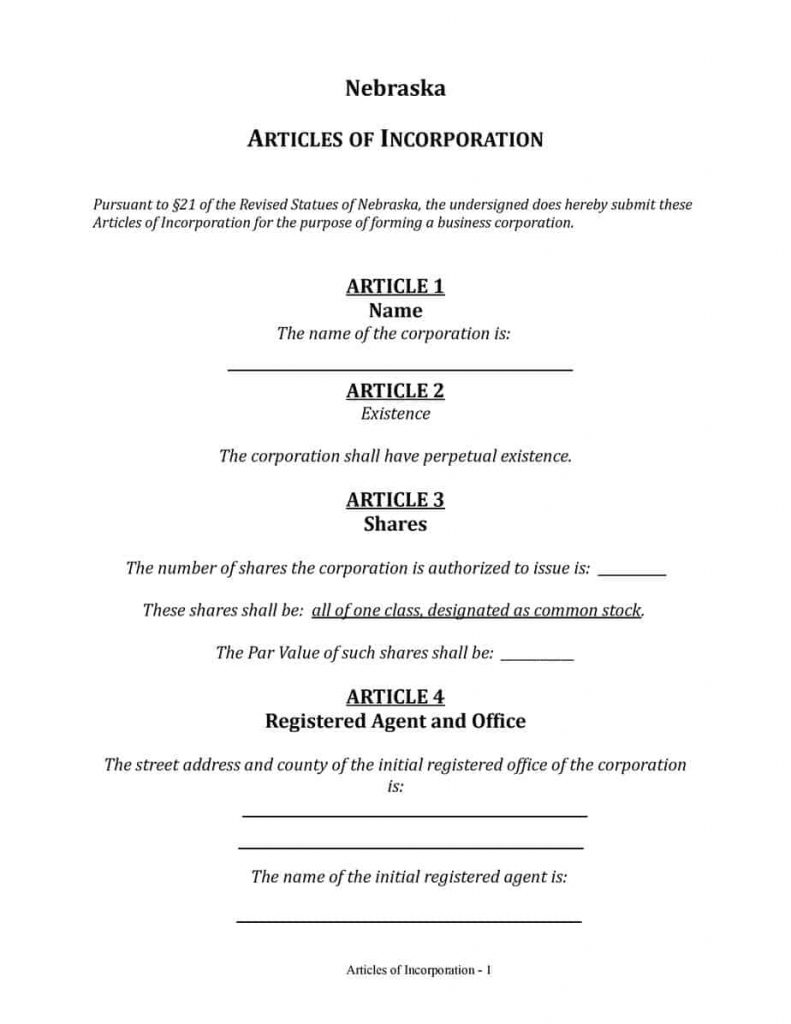

To start a nonprofit corporation in Nebraska, begin by filing Nonprofit Articles of Incorporation with the Nebraska Secretary of State. You can file your nonprofit's articles by mail or online.

Once Articles of Incorporation are filed with the state, you've officially created your nonprofit corporation, but truly preparing a nonprofit to pursue its mission involves several additional steps.

Starting a Nebraska Nonprofit Guide:

- Choose your Nebraska nonprofit filing option

- File Nebraska Nonprofit Articles of Incorporation

- Get a Federal EIN from the IRS

- Adopt your nonprofit's bylaws

- Apply for tax exemptions

- Apply for required state licenses

- Open a bank account for your Nebraska nonprofit

- Submit your NE nonprofit's biennial report

Nebraska Nonprofit Filing Options

Free PDF Download

Instructions for Nebraska Nonprofit Articles of Incorporation. When you complete your articles, submit them to the state.

Do It Yourself Online

Our free account and tools will walk you through starting and maintaining a Nebraska nonprofit. All for free.

$39 + State Fees

Our nonprofit formation service includes free year of registered agent, bylaws, website, domain & more.

Nebraska Nonprofit Articles of Incorporation Requirements

To incorporate a Nebraska nonprofit, you must file the Nonprofit Articles of Incorporation with the Nebraska Secretary of State. Unfortunately, Nebraska doesn’t provide a form for your articles of incorporation, so you’ll need to prepare the document yourself, print it and mail it, or upload the file to the state’s Corporate Document eDelivery system.

The Secretary of State requires the following information to file Nonprofit Articles of Incorporation:

The name also can’t suggest your nonprofit exists for purposes different from those allowed by Nebraska law or indicated by your nonprofit’s Articles of Incorporation.

If your nonprofit intends to seek 501(c)(3) tax-exempt status with the IRS, your articles should include a dissolution of assets clause using the specific language the IRS requires.

For example, you may include the names and addresses of your nonprofit’s initial directors, information from your bylaws about classes of members and their rights, and regulations limiting the powers of your nonprofit’s board of directors.

What is the fee to incorporate a Nebraska nonprofit?

Nebraska charges $30 to file Nonprofit Articles of Incorporation with a paper form. If you file online, it’ll cost you $25 plus a $2 statutory filing fee, for a total of $27.

How long does it take to start a Nebraska nonprofit?

It takes a day or two for the Nebraska Secretary of State to process filings made online. Paper filings can take longer, up to two weeks after being received by the state.

What are publishing requirements for a Nebraska nonprofit?

Your Nebraska nonprofit will have to publish a Notice of Incorporation in a local newspaper for three consecutive weeks after you submit your Articles of Incorporation, per NE Code §21-19,173. Nonprofit corporations need to list the following: name; whether they’re public benefit,mutual benefit or religious; registered agent and office, name and address of incorporator and whether or not the corporation will have members.

For details, see our guide to publishing a Nebraska Notice of Incorporation.

Do I need a Nebraska nonprofit registered agent?

Yes, Nebraska requires nonprofit corporations to appoint a registered agent to receive legal notices and other official state mail on their behalf. You can be your own registered agent or designate an associate, but a registered agent has to be reliably available at a specific Nebraska street address during normal business hours.

That means if you do the job yourself, you’ll need to list your own residential or office address on your nonprofit’s Articles of Incorporation. That information then becomes part of the public record and accessible to anyone. It also restricts you to that location while you wait for the possible arrival legal mail and service of process.

When you hire Northwest, we’ll be the ones doing the waiting, so you’re free to focus on the work of managing and growing your nonprofit. Your Articles of Incorporation can also list our Nebraska street address instead of yours, which helps protect your privacy. And if we ever do receive a service of process for your nonprofit, we’ll scan it and send it to you on the day we receive it.

Get a Federal EIN from the IRS

Your nonprofit will need a Federal Employer Identification Number (EIN) to effectively navigate its finances, open a bank account, and apply for federal or state tax exemptions. After the Nebraska Secretary of State approves your Articles of Incorporation, you can apply for an EIN on the IRS website. Or let us handle it by adding EIN service when you hire Northwest to form your Nebraska nonprofit.

Hold Your Organizational Meeting & Adopt Bylaws

Nebraska requires a nonprofit corporation’s board of directors to adopt bylaws. Most nonprofits will do this at an organizational meeting—the first official meeting at which you elect directors and officers, adopt bylaws, and complete whatever other business is necessary to get your nonprofit ready to conduct business. Make sure your nonprofit adopts its bylaws before applying for 501(c)(3) status with the IRS, since the IRS only wants to deal a fully-formed organization.

Writing effective bylaws might seem challenging, but Northwest is here to help. When you hire Northwest, you can use our adaptable template for writing nonprofit bylaws, as well as our other free nonprofit forms, to help you get started.

Apply for Tax Exemptions

Will My Nebraska Nonprofit Be Tax-Exempt?

Unfortunately, forming as a nonprofit doesn’t automatically qualify your organization for tax-exempt status. You’ll need to submit an Application for Recognition of Exemption to the IRS (Form 1023, 1023-EZ, or 1024) and pay a $275 or $600 filing fee, depending on the size and nature of your nonprofit. There is also an application process that takes at least three months and possibly more than six, where the IRS examines your organization’s structure, formation documents, purpose, and finances.

The IRS recognizes more than two dozen types of exempt organizations, but most nonprofits seek 501(c)(3) tax-exempt status for public charities and private foundations. If you go this route, it’s best to plan well in advance. Your nonprofit’s Articles of Incorporation should include a statement of purpose and dissolution of assets provision using specific language required by the IRS.

Essentially, your nonprofit must dedicate its income and assets to pursuing an IRS-recognized exempt purpose (religious, charitable, educational, etc.) and structure your organization so it will always serve public (not private) ends.

What About Nebraska State Tax Exemptions?

If your nonprofit manages to obtain 501(c)(3) status, your organization will automatically qualify for an exemption from the Nebraska state income tax (and you don’t even need to apply!). However, you’ll need to apply to the Department of Revenue for a sales and use tax exemption, and not all nonprofit corporations qualify. Visit Northwest’s guide to Nebraska state tax exemptions if you’d like to learn more.

Obtain Nebraska State Accounts & Licenses

Does a Nebraska Nonprofit Need a Business License?

Nebraska doesn’t issue a statewide business license, so whether or not you’ll need a business license (or licenses) depends on your nonprofit’s activities and location. Contact your city clerk’s office to find out which (if any) licenses and permits apply to your nonprofit.

Should My Nebraska Nonprofit Register For State Tax Accounts?

That depends on your nonprofit’s structure and activities. If your nonprofit will have employees, for instance, you will likely need to register with the Nebraska Department of Revenue to pay withholding taxes. To get a Nebraska State Identification Number, you can register online or complete the Nebraska Tax Application. There are filing fees only for specific programs (see section 15 of the form).

Do I Have To Register My Nonprofit as a Charity in Nebraska?

No. Nebraska no longer requires charities to register with the Attorney General’s office.

Banking For Your Nebraska Nonprofit

To open a bank account for your Nebraska nonprofit, you will need to bring the following items to the bank:

- A copy of your Nebraska nonprofit’s Articles of Incorporation

- A copy of your nonprofit’s bylaws

- Your Nebraska nonprofit’s EIN

We recommend calling your bank ahead of time to determine their requirements. If your nonprofit has several directors and/or officers, you may even need to bring a resolution authorizing you to open the account in the name of your nonprofit.

Nebraska Nonprofit Biennial Reporting

Nebraska requires nonprofits to submit a biennial report by April 1st of each odd-numbered year. The report gives the state updated information about your nonprofit, such as your registered agent’s name and address and the names and addresses of each officer and director. There is a $20 filing fee for nonprofit corporations.

Rather not deal with this report? You can sign up for our Nebraska Biennial Report Service for an additional fee when you hire Northwest.