How to Start a Series LLC in Wyoming

To create a Series LLC in Wyoming, you’ll need to submit the Series Limited Liability Company Articles of Organization to the Wyoming Secretary of State. This document can be submitted online or by mail. The Series LLC Articles of Organization costs $100 to file (+ $4 for online filings) plus $10 for each series you form. Filing the Articles of Organization with the state officially establishes your Wyoming Series LLC, but you’ll have to take several additional steps to finish setting up your business.

What is a Wyoming Series LLC?

A Wyoming Series LLC is a special kind of limited liability company (LLC). Like a traditional Wyoming LLC, a Wyoming Series LLC is a legal entity separate from its owners. Unlike a traditional LLC, a Wyoming Series LLC can divide itself into units called series. Each series can have its own business purpose, assets, bank account, and—if properly maintained—limited liability.

This means that in the case of a lawsuit, an individual series in a Wyoming Series LLC typically won’t be held liable for the debts of the parent LLC or any of the series within it. Basically, a Wyoming Series LLC allows you to start and run several separate businesses under one LLC, without the need to file formation documents or annual reports for each series.

Series LLCs are offered in more than a dozen states. To learn about the Series LLC business structure in general, which states allow it, and the main steps involved in starting a Series LLC, see our Series LLC Guide.

WY Series LLC Articles of Organization Requirements

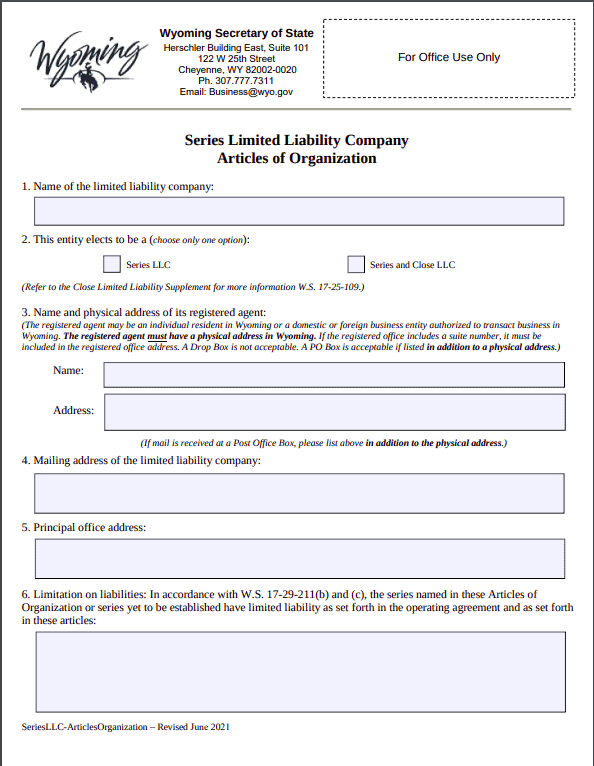

To form a Wyoming Series LLC, you must submit the Wyoming Series LLC Articles of Organization to the Wyoming Secretary of State. See the document below and instructions for how to fill it out.

How much does it cost to start a Wyoming Series LLC?

It costs $100 to file the Wyoming Series LLC Articles of Organization plus $10 for each series established. Wyoming adds a $4 fee for online filings. You can pay by credit card if you file online and check or money order if you file by paper.

How long does it take to form a Wyoming Series LLC?

Online filings are typically processed as soon as they’re received. Paper filings take a few days to process after the state receives them.

Does a Wyoming Series LLC need a registered agent?

Yes. Your Wyoming Series LLC is legally required to appoint and maintain a Wyoming registered agent to receive service of process and other official mail on its behalf. Your registered agent must have a physical street address in Wyoming and be available during business hours to accept and forward legal correspondence.

How do I add series to my Wyoming Series LLC after it’s formed?

If you want to add more series to your Wyoming Series LLC after you form it, you’ll need to file a Wyoming LLC amendment.

Does each series of a Wyoming Series LLC need its own registered agent?

No. Each series in your Wyoming Series LLC shares a registered agent with the parent LLC.

What is a Wyoming Close LLC?

A Close LLC in Wyoming has membership transfer restrictions that make it harder for creditors or outside parties to receive a controlling membership in the LLC. This can help small, family-owned companies maintain control of their business.

To learn more, see our page on Wyoming Close LLCs.

Create a Wyoming Series LLC Operating Agreement

Your Wyoming Series LLC operating agreement is just what it sounds like—an agreement between members on how your Wyoming Series LLC will operate. It’s one of your organization’s most important documents. The operating agreement should cover who owns the Series LLC, which members are associated with which series, how the organization will deal with disagreements, and how your LLC can be dissolved (among other things). It’s an internal document, so you don’t have to file it with the Wyoming Secretary of State.

While your operating agreement is an internal document, your Wyoming Series LLC is required to have one. And just like in your articles, you’ll need to give notice of the limitations of liabilities—i.e. that the LLC and each series under it has its own debts, assets, obligations, etc.

Get Federal EINs from the IRS

Does my Series LLC Need a Federal EIN?

Yes. An EIN is necessary for hiring employees, changing your tax designation, getting a business license, and opening a business bank account. You can apply for an EIN through the IRS website.

Should I get a separate EIN for Each Series in my Wyoming Series LLC?

Yes, probably. To maintain your Series LLC’s limited liability, you need to keep the finances of each series separate. To do that, you’ll need to open a separate bank account for each series. To open separate bank accounts, you’ll need separate EINs.

Open Bank Accounts for your Series LLC

To open a bank account for your Wyoming Series LLC, you’ll need to bring to the bank:

- A copy of your Wyoming Series LLC Articles of Organization

- Your Series LLC operating agreement

- Your Series LLC’s EIN

If your Series LLC has more than one member, you might want to bring an LLC resolution to open a bank account stating that the person opening the account on behalf of the LLC is authorized to do so by the other members.

File Wyoming Series LLC Reports

Every year, you’ll have to file the Wyoming Annual Report and pay a filing fee (sometimes called a license tax). The filing fee is calculated based on your LLC’s assets. If your LLC’s total assets are $300,000 or less, you’ll pay the minimum fee of $60. If your LLC’s assets are greater than $300,000, you’ll multiply that total value by 0.0002 to calculate your filing fee.

Luckily, you only need to file one annual report for your Wyoming Series LLC, not one for each series. You’ll need to add up the assets of each series to find your LLC’s total assets.

Learn more with Northwest’s Wyoming Annual Report Service & Filing Guide.