How to Start a Nonprofit in Wisconsin

To start a nonprofit corporation in Wisconsin, you must file a document called the Articles of Incorporation Non-Stock, Not for Profit Corporation with the Wisconsin Department of Financial Institutions. You can file your articles by mail or online. The articles cost $35 to file. Once filed with the state, your articles of incorporation officially create your Wisconsin nonprofit corporation, but truly preparing a nonprofit to pursue its mission involves several additional steps.

Starting a Wisconsin Nonprofit Guide:

- Choose your WI nonprofit filing option

- File WI nonprofit articles of incorporation

- Get a Federal EIN from the IRS

- Adopt your nonprofit’s bylaws

- Apply for federal and/or state tax exemptions

- Apply for any required state licenses

- Open a bank account for your WI nonprofit

- Submit the WI nonprofit annual report

Wisconsin Nonprofit Filing Options

Free PDF Download

Download the Wisconsin nonprofit articles of incorporation. Fill out the form and submit to the state.

Do It Yourself Online

Our free account and tools will walk you through starting and maintaining a Wisconsin nonprofit. All for free.

$39 + State Fees

Our nonprofit formation service includes free year of registered agent, bylaws, website, domain & more.

WI Nonprofit Articles of Incorporation Requirements

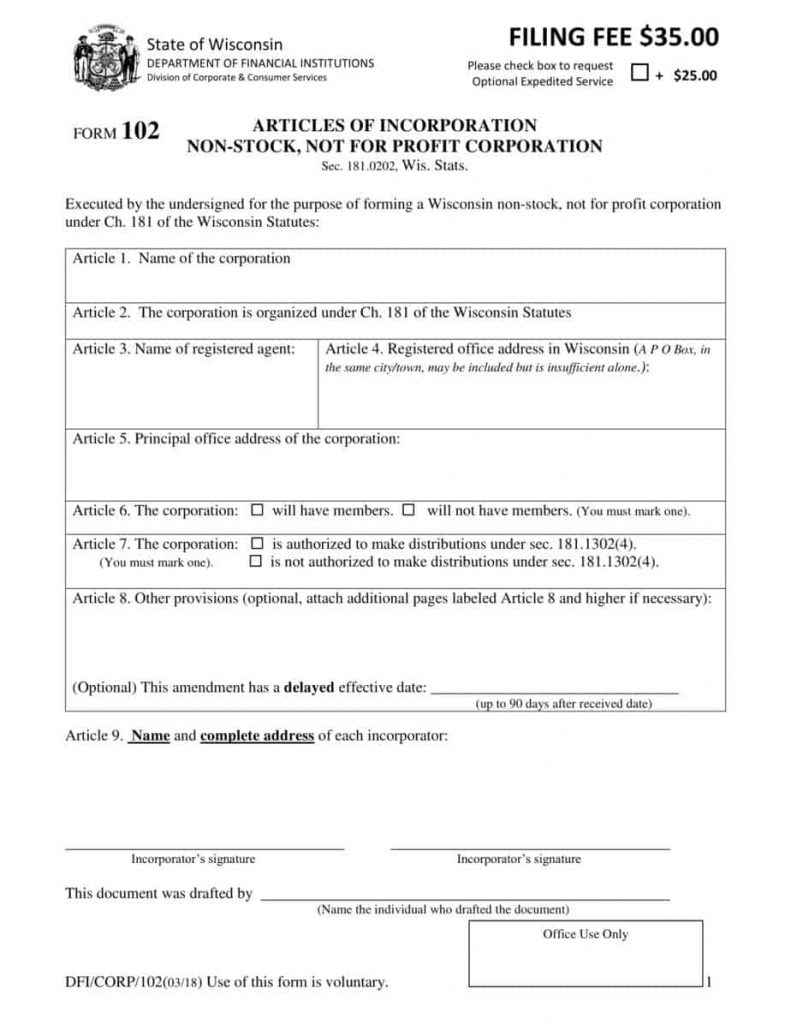

To incorporate a Wisconsin nonprofit, you must complete and file nonprofit articles of incorporation (Form 102) with the Wisconsin Department of Financial Institutions (DFI). See the document below and click on any number to see what information is required in the corresponding section.

How Much Does It Cost to Incorporate a Wisconsin Nonprofit?

Wisconsin charges $35 to file nonprofit articles of incorporation. If you file by mail, you can add on a $25 expedite fee to speed up the filing process. Online filings already take less time than mailed filings.

How Long Does It Take to Start a Wisconsin Nonprofit?

Online filings usually take one business day, though it can sometimes take up to five business days. It takes more time generally for mailed submissions (4-7 business days), but you can also pay an extra $25 for 2-day expediting.

Does a Wisconsin Nonprofit Need a Registered Agent?

Yes, your nonprofit must appoint and maintain a Wisconsin registered agent to accept service of process (legal notices) on its behalf. The registered agent can be you, a willing associate, or a registered agent service like Northwest. If you decide to take on the job yourself, keep in mind that it’s a real commitment. A registered agent must be available at a publicly listed address (a registered office) during normal business hours, and this address goes into the public record. It can be tough to manage and grow a new nonprofit when you’re tied to your desk, and you can expect a mailbox full of junk mail if you put your own home or office address on your nonprofit’s articles of incorporation.

A better option? Hire Northwest instead. Not only will hiring Northwest help resolve the issues mentioned above because our address goes on your articles of incorporation in place of yours, but you’ll also gain access to our expert registered agent services. And if we ever do receive a service of process for your nonprofit, we’ll scan it and send it to you on the day we receive it.

Get a Federal Employer Identification Number (EIN)

Your nonprofit is required to get an employer identification number (a FEIN or EIN) even if it doesn’t have employees. You’ll need an EIN to open a bank account and apply for federal tax-exempt status with the IRS, and you can get an EIN as soon as the state approves your nonprofit’s articles of incorporation. Applying is free, and you can apply online at the IRS website, by mail, or by fax. Or you can let us get your EIN for you by adding our convenient EIN service, for an additional $50 fee, when you hire Northwest.

Hold Your Organizational Meeting & Adopt Bylaws

Wisconsin requires nonstock corporations to adopt bylaws at their first official meeting. This is the meeting where your nonprofit elects its directors, appoints officers, and takes care of any other official business necessary to fully complete your organization’s formation and begin its operations. Nonprofits that intend to seek 501(c)(3) federal tax-exempt status should adopt their bylaws before submitting the Application for Recognition of Exemption to the IRS.

It isn’t easy to write effective bylaws, but Northwest can help. When you hire Northwest to form your Wisconsin nonprofit, you can also use our adaptable template for writing nonprofit bylaws, along with numerous other free nonprofit forms, to help get things started.

Apply for Federal and/or State Tax Exemptions

Will my Wisconsin nonprofit be tax-exempt?

Not automatically. To obtain federal tax-exempt status, you’ll need to organize your nonprofit in a way that satisfies at least one of the tax-exempt categories defined by the IRS under Section 501(c) of the Internal Revenue Code. Although there are numerous types of tax-exempt nonprofits, most nonprofits exist to serve charitable purposes and seek 501(c)(3) federal tax-exempt status for public charities and private foundations. This involves submitting an Application for Recognition of Exemption (Form 1023 or 1023-EZ), paying a $275 or $600 filing fee, and enduring the 3-6 month process of having your organization’s structure, purpose, and finances examined by the IRS. You will also need to make sure your nonprofit’s articles of incorporation include provisions using the specific language required by the IRS.

If your organization manages to obtain 501(c)(3) status, contributions to your organization will be tax-deductible by their donors, and your organization will not have to pay the federal corporate tax.

What about state tax exemptions?

If your nonprofit obtains federal tax exempt status, it will be exempt automatically from the Wisconsin franchise and income taxes. Most 501(c)(3) organizations are also exempt from the Wisconsin sales tax, but you will need to obtain an Exempt Status number. For more information, please visit Northwest’s guide to Wisconsin state tax exemptions.

Obtain Wisconsin State Licenses

Does a Wisconsin nonprofit need a business license?

Wisconsin doesn’t issue a statewide business license, but local jurisdictions may have licensing requirements of their own. It’s usually best to contact your local city clerk’s office to find out which (if any) licensing requirements apply to your nonprofit’s activities.

Should my nonprofit register with the Wisconsin Department of Revenue?

Most likely, especially if your nonprofit will have employees or sell goods of any kind. To register, you’ll submit Form BTR-101 (the Application for Business Tax Registration) to the Wisconsin Department of Revenue. There is a $20 initial registration fee, and you’ll pay $10 to renew your registration every two years.

Should my nonprofit register as a Wisconsin charity?

Before your Wisconsin nonprofit solicits contributions in the state, you must register as a Wisconsin charity with the Department of Regulation and Licensing. You will need to submit a Charitable Organization Registration Statement. There is a $15 charity registration fee and a $54 charitable organization renewal each year.

Open a Bank Account for Your Wisconsin Nonprofit

To open a bank account for your Wisconsin nonprofit, you will need to bring the following items with you to the bank:

- A copy of your Wisconsin nonprofit articles of incorporation

- A copy of your nonprofit’s bylaws

- Your Wisconsin nonprofit’s EIN

It’s wise to call your bank ahead of time to check its requirements. Some banks may require you to bring a resolution authorizing you to open a bank account in your nonprofit’s name (particularly if your nonprofit has several directors and/or officers).

Submit the Wisconsin Nonprofit Annual Report

Wisconsin requires nonprofits to submit annual reports each year updating (or merely confirming) your organization’s information as it appears on the state’s records. There is a $10 filing fee, and the report is due at the end of your organization’s anniversary quarter each year. You can file your Wisconsin nonprofit’s annual report online at the Wisconsin Department of Financial Institution’s website.

When you hire Northwest, we’ll automatically remind you about your nonprofit’s annual report deadlines, but you can also sign up for our Wisconsin Annual Report Service, for an additional fee, and leave the hassle to us.