How to File a Florida LLC Amendment

When you need to update your Florida LLC’s Articles of Organization, you can do it by filing an Articles of Amendment form with the Florida Department of State’s Division of Corporations. Articles of Amendment must be filed by mail and carry a $25 fee. Learn all about the Florida LLC amendment process with this guide.

In this article, we’ll cover:

- Amending Florida LLC Articles of Organization

- Florida LLC Articles of Amendment Form Information

- Filing Florida LLC Articles of Amendment

Amending Florida LLC Articles of Organization

The Articles of Organization you file when you create a Florida LLC with the Department of State registers important information about your company with the state. As your LLC grows, that information may change, so you’ll need to keep it updated and accurate in order for your company to remain compliant with state law and be found for delivery of service of process and other legal notices. You can change much of your LLC’s information by filing an Articles of Amendment to Articles of Organization form.

What can I change with Florida LLC Articles of Amendment?

You need to file Articles of Amendment when your LLC changes the following information:

- Business name (new names must include “Limited Liability Company,” “LLC” or “L.L.C.”)

- Principal address (street addresses only)

- Mailing address (post office boxes can be used for mailing addresses)

- Manager names and addresses (or authorized members, if the LLC is member-managed)

You can also change your LLC’s registered agent or registered office address with an amendment. If changing your registered agent, you’ll need to include the new agent’s signature. Registered agent updates can also be done with a Statement of Change of Registered Office or Registered Agent form for $25, the same fee as filing Articles of Amendment. Either method works.

In addition, you can use Articles of Amendment to add, amend, or remove any optional provisions in your Articles of Organization. This may include information that is not a standard part of a Florida LLC’s Articles of Organization: such as the length of time the LLC will be in existence (if not indefinitely) or describing a purpose for the business.

Yes, you can file Restated Articles of Organization any time. Restating articles accomplishes the same thing as amending the document, but by different means. Amended Articles of Organization change, add or subtract material from the existing articles but still include the original content of the articles. Restating the Articles of Organization means writing an entirely new document to replace the original.

If you wish to restate the initial articles you must use the title, “Restatement of Articles of Organization” (or “Amended and Restated Articles of Organization” if the restated articles incorporates amendments). There is no form provided by the Florida Department of State for restating articles, so you’ll need to draft your own document using the rules set by Florida Revised Limited Liability Company Act § 605.0202. The filing fee for restated articles is $25.

No, if a mistake was made on your LLC’s Articles of Organization, you shouldn’t file Articles of Amendment. You’ll want to file a Statement of Correction instead. This form will allow you to fix any errors or typos that need to be corrected on your Articles of Organization and can be filed for $25—just like Articles of Amendment.

Need help with filing Articles of Amendment for your Florida LLC? Sign up for a free account with Northwest Registered Agent today and get access to our library of business forms.

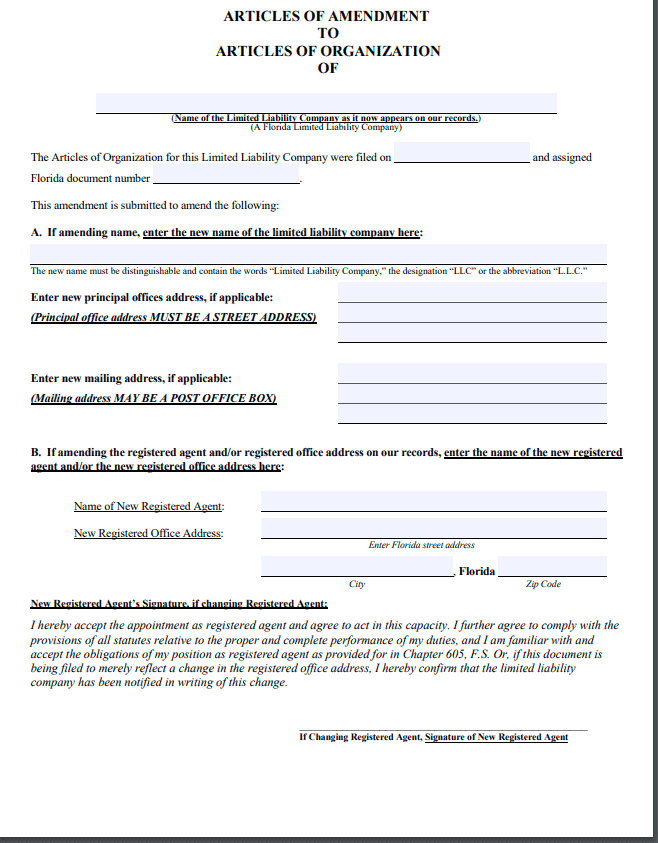

Florida Articles of Amendment Form Information

Florida requires you to provide a cover letter with information about your LLC and the person filing the document when submitting Articles of Amendment. The cover letter form is included with Florida’s Articles of Amendment template, and requires:

- LLC’s current name as filed with the Department of State.

- Name of the person filing the amendment.

- Filing company name, if applicable (if the amendment is filed by a professional registered agent service, the name of that business goes here).

- Mailing address of the person filing the amendments.

- Email address for notifications.

- Name and phone number of an individual to contact about the filing.

In addition, the cover letter should indicate whether the fee enclosed with the form is just for the Articles of Amendment, or if additional money was paid for a certificate of status or certified copy of the filing.

On the Articles of Amendment form itself, in addition to the information being amended, you’ll need to include the following:

- Current LLC name.

- Original date Articles of Organization were filed.

- 6-12 digit Florida document number of the original Articles of Organization.

- Date the amendments will go into effect, if other than the filing date (up to 90 days later).

- Dated signature and printed name of an LLC member or authorized representative.

Filing Florida LLC Articles of Amendment

To amend your LLC, send the completed Articles of Amendment form to the Florida Department of State, along with a filing fee. Articles must be delivered by mail.

Mail filings:

Registration Section

Division of Corporations

P.O. Box 6327

Tallahassee, FL 32314

It costs $25 to file Florida Articles of Amendment. You can also request a Certificate of Status for the articles for an additional $5 fee, and/or a Certified Copy for an additional $30. You will need to include a duplicate Articles of Amendment form for the Certified Copy.

Filings can be paid with a check or money order payable to “Florida Department of State.”

Standard processing time for Florida LLC filings takes 3-4 weeks. Florida does not offer expedited processing for Articles of Amendment.