How To Start A Nonprofit In Louisiana

To start a nonprofit corporation in Louisiana, you must file nonprofit Articles of Incorporation with the Louisiana Secretary of State. You can file in person, online, by fax, or by mail. The Articles of Incorporation cost $75 to file (plus an additional $5 if you pay with a credit card).

Once filed with the state, your Articles of Incorporation officially create your Louisiana nonprofit corporation, but truly preparing a nonprofit to pursue its mission involves several additional steps.

Starting a Louisiana Nonprofit Guide:

- Choose your LA nonprofit filing option

- File the LA nonprofit articles of incorporation

- Get a Federal EIN from the IRS

- Adopt your nonprofit's bylaws

- Apply for federal and/or state tax exemptions

- Apply for any required business licenses

- Open a bank account for your LA nonprofit

- Submit the LA nonprofit annual report

Louisiana Nonprofit Filing Options

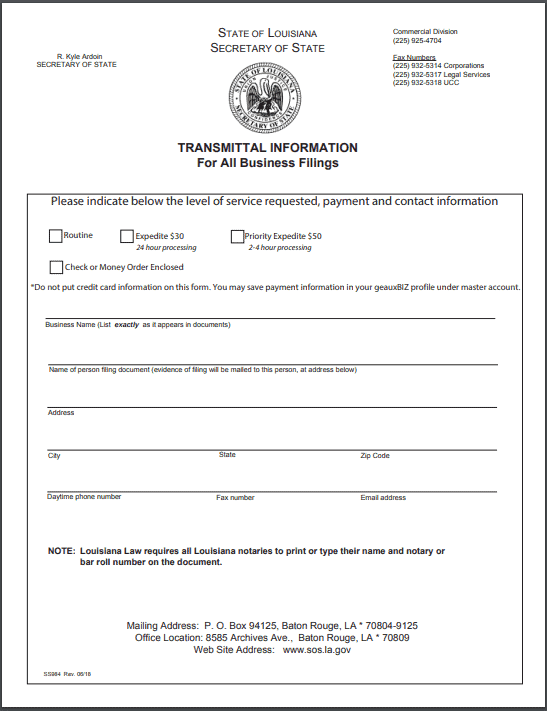

Free PDF Download

Download the Louisiana Nonprofit Articles of Incorporation. Fill out the form and submit to the state.

Do It Yourself Online

Our free account and tools will walk you through starting and maintaining a Louisiana nonprofit. All for free.

$39 + State Fees

Our nonprofit formation service includes free year of registered agent, bylaws, website, domain & more.

LA Nonprofit Articles of Incorporation Requirements

To incorporate a Louisiana nonprofit, you must complete and file the Louisiana nonprofit Articles of Incorporation with the Louisiana Secretary of State. See the document below and click on any number to see what information is required in the corresponding section.

How Much Does It Cost To Incorporate A Louisiana Nonprofit?

Louisiana charges a $75 filing fee to register nonprofit corporations, along with a $5 credit card processing fee that applies to both in-person and online filings).

How Long Does it Take To Incorporate A Louisiana Nonprofit?

Louisiana typically processes filings within 2 business days. Expedited 2-4 hour processing is available for walk-in filings and costs an additional $50.

Does a Louisiana Nonprofit Need a Registered Agent?

Absolutely. Your nonprofit will need to appoint and maintain a Louisiana registered agent to receive service of process (legal notices) on its behalf. The state will allow you to appoint yourself or a willing friend, but we recommend hiring a commercial registered agent service like Northwest.

Why? Because a registered agent has to be available to receive legal notices at a publicly listed Louisiana street address during normal business hours, so doing the job yourself means being stuck at your desk all day when you need to be doing other things. Hire Northwest, let us do the waiting, and devote your time to managing and growing your new nonprofit.

Get a Federal EIN from the IRS

Do I Need a Tax ID Number (EIN) for a Louisiana Nonprofit?

A Federal Employer Identification Number (FEIN or EIN) is like an individual’s social security number—it’s hard to come across as legitimate without one, and you’ll need an EIN, in any case, to apply for federal and state tax exemptions and open a bank account in your nonprofit’s name.

After Louisiana files your Articles of Incorporation, you can apply for an EIN on the IRS website. And if you’d rather not deal with the IRS, you can sign up for our convenient EIN service for an additional fee when you hire Northwest.

Hold Your Organizational Meeting & Adopt Bylaws

Louisiana law requires a nonprofit corporation to adopt bylaws at its organizational meeting. The meeting usually happens shortly after filing Articles of Incorporation with the state.

Your bylaws set the tone for how your directors, officers, and members behave, and they answer important organizational questions in advance. For instance, how does someone become a director? What are the president’s responsibilities? Who has the right the vote? What are the rights and limitations of your nonprofit’s members? Does your nonprofit even have voting members? (And so on!)

Writing effective bylaws isn’t easy, but you won’t have to go it alone if you hire Northwest. Hire Northwest, and we’ll provide you with an adaptable template for writing nonprofit bylaws, as well as other free nonprofit forms, to help get things started. We even offer a free attorney-drafted nonprofit bylaws template!

Apply for Federal and/or State Tax Exemptions

Will My Louisiana Nonprofit Be Tax-Exempt?

Not automatically. To obtain federal tax-exempt status, you’ll need to submit an Application for Recognition of Exemption to the IRS, pay a $275 or $600 fee (depending on the size and nature of your nonprofit), and wait around 3-6 months while the IRS examines your application and makes its decision. There are quite a few types of exempt organizations, but most nonprofits pursue 501(c)(3) status for public charities and private foundations, and this involves shaping your Articles of Incorporation to include specific tax-exempt provisions required by the IRS. To learn more, visit Northwest’s guide to getting 501(c)(3) tax-exempt status.

If everything goes well, you’ll receive an IRS determination letter recognizing your nonprofit as a tax-exempt entity. Then you can send that letter to the Louisiana Department of Revenue to qualify for an exemption from the state income tax. Most Louisiana nonprofits, however, still pay the state’s sales and use tax, though it’s possible to obtain exemptions for specific fund-raising activities. Learn more at Northwest’s guide to Louisiana state tax exemptions.

Obtain Louisiana State Licenses

Does a Louisiana Nonprofit Need a Business License?

Louisiana doesn’t issue a statewide business license, but individual parishes and cities often have licensing requirements of their own. Visit Louisiana’s geauxBiz website to learn about the licensing requirements for your nonprofit.

Will My Nonprofit Need a Louisiana Revenue Account Number?

Yes. Your nonprofit must register for a revenue account number, as well as for individual tax accounts, with the Louisiana Department of Revenue. File Form R-16019 (the Application for Louisiana Revenue Account Number) at the Department of Revenue’s website or by mail. There is no filing fee.

Do I Have to Register My Nonprofit as a Charity in Louisiana?

In most cases, no. If your nonprofit qualifies as a charity under Louisiana state law, it is only required to register as a charity with the Louisiana Attorney General if it also employs a professional solicitor.

Open a Bank Account for Your LA Nonprofit

To open a bank account for your Louisiana nonprofit, you will need to bring the following items with you to the bank:

- a copy of your Louisiana nonprofit’s Articles of Incorporation

- a copy of your nonprofit’s bylaws

- your Louisiana nonprofit’s EIN

It’s wise to call your ahead of time to check its requirements. Some banks may require you to bring a resolution authorizing you to open a bank account in your nonprofit’s name (particularly if your nonprofit has several directors and/or officers).

Submit the LA Nonprofit Annual Report

What is the Louisiana Nonprofit Annual Report?

Louisiana requires nonprofits to file annual reports updating membership and contact information. There is a $10 fee (plus a $5 processing fee if you pay with a credit card), and you can submit the report online at Louisiana’s geauxBIZ portal. The report should include the physical and mailing address of your nonprofit’s registered office, the name and address of your registered agent, and the names, addresses, and term expiration your nonprofit’s directors and officers. Your nonprofit’s annual report is due no later than the anniversary date of its incorporation.

When you hire Northwest to form your nonprofit or serve as your registered agent, we’ll send you reminders to file your annual report. Or, you can add our convenient nonprofit Louisiana Annual Report Service for an additional fee and leave the submission of your annual report to us.